What Impact will November Restrictions Have on OOH Audiences?

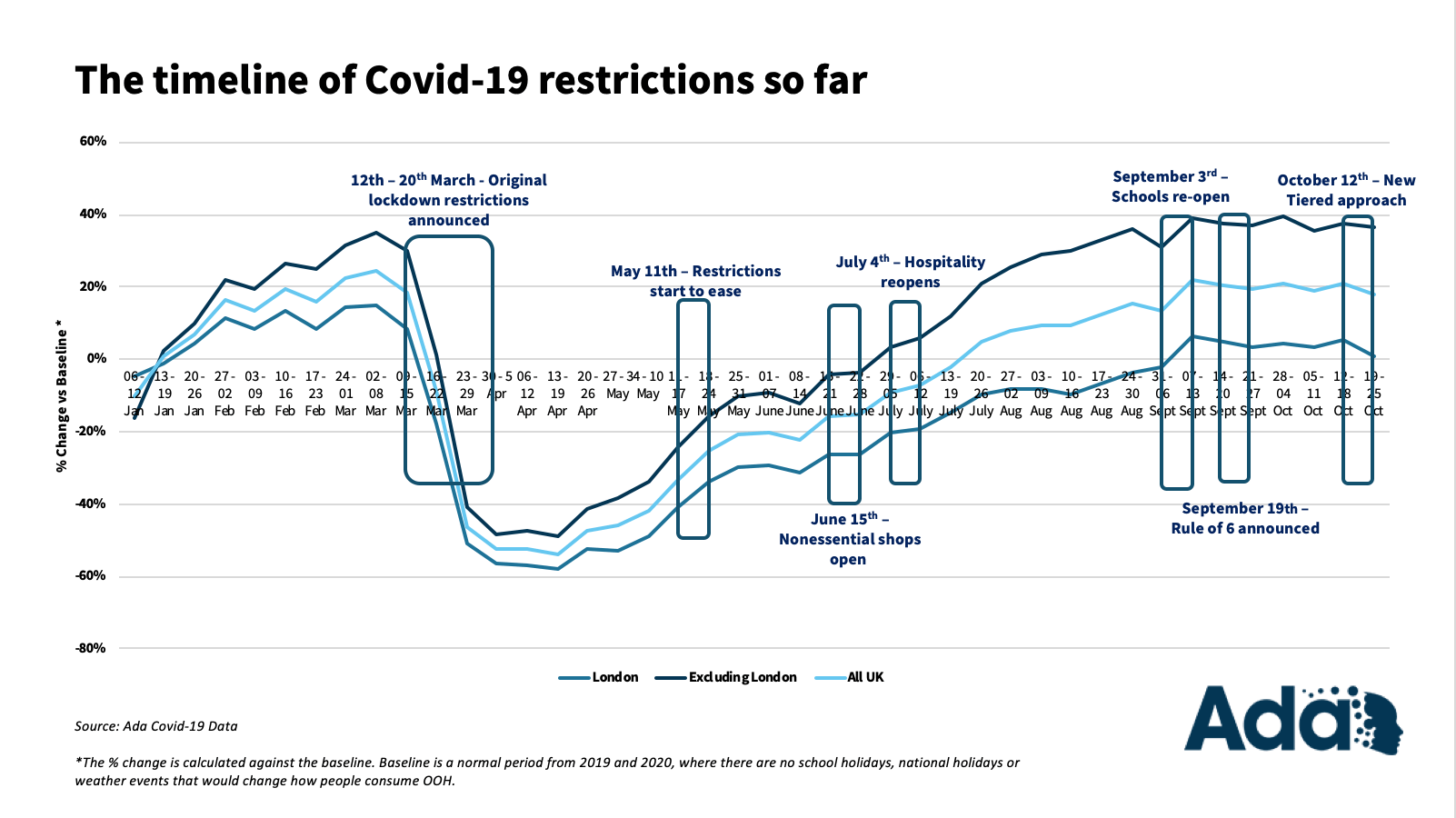

Throughout 2020, Ada, Talon’s Out of Home data management platform, has been evaluating the effects of COVID-19 on OOH audiences and their behaviours. From the national lockdown back in March and various local restrictions since, Ada has helped us to understand these behaviours and has provided valuable insight for our clients, enabling them to adapt their strategies.

With a new national lockdown in place, we’ve examined the current year’s timeline of restrictions to understand the likely impact this lockdown will have, bearing in mind that the regulations – which apply to England – differ from those we saw in March.

Schools, colleges and universities across the UK remain open, as well as essential businesses, takeaways and click & collect facilities within retail. As many as 25 retail and hospitality categories will actually remain open, providing essential services. There’s no limit on time spent outside of the house and people are able to meet one person per day outside of their household for outdoor activities. The restrictions are in place for a fixed period and are set to be lifted on December 2nd.

In recent weeks, mobility, roadside traffic, visits to points of interest and OOH exposure have all been above average. Roadside OOH exposure sits strong at +18% and going into lockdown at a higher audience level means we should not see as dramatic a decrease as we did back in March.

What we expect to see

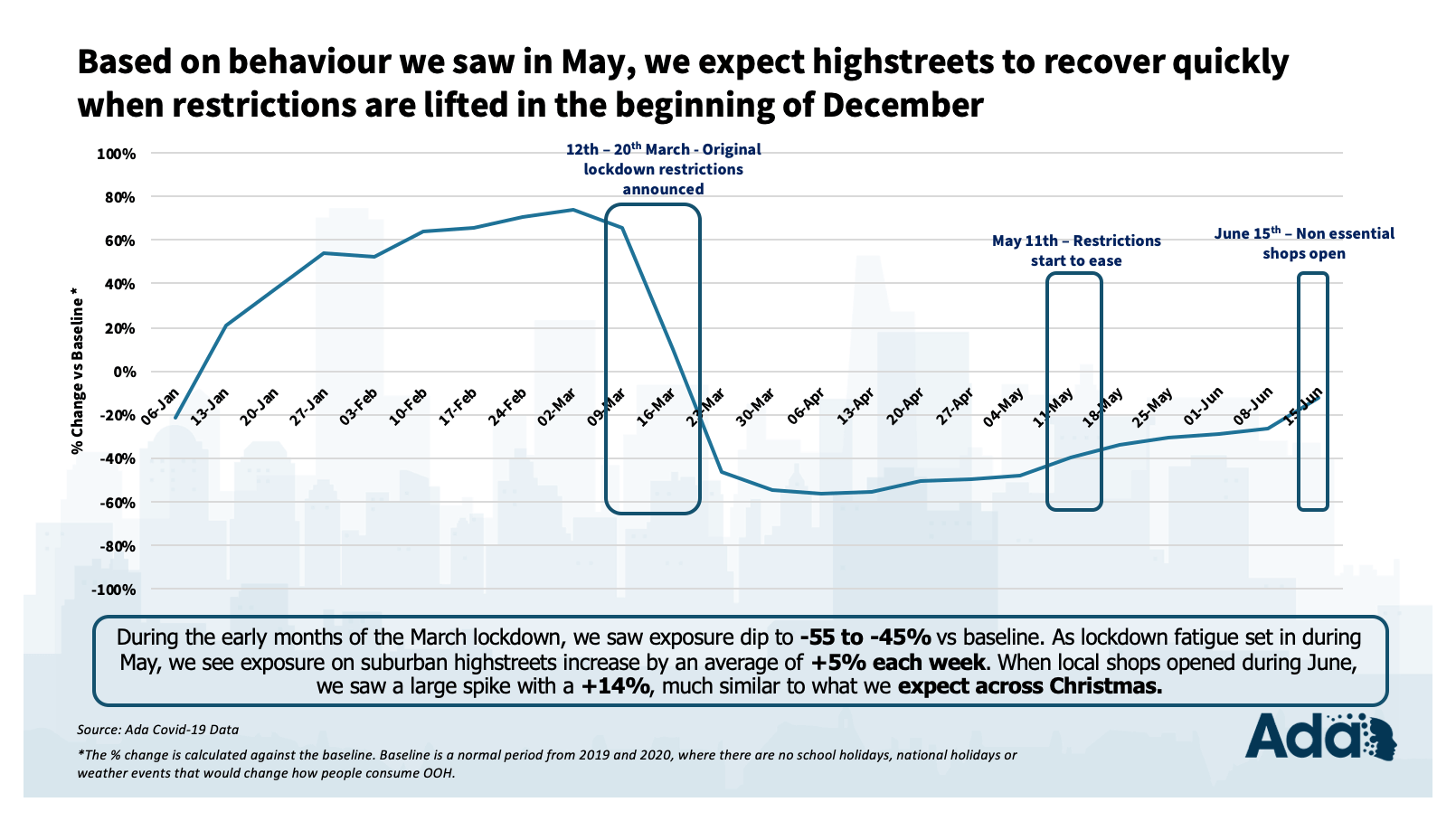

To analyse the impact of the November lockdown as accurately as possible, we’ve taken Ada mobility data from May 2020 (a month with a broadly similar level of restrictions to now) and November 2019 into account. We expect UK roadside traffic to decline by around a third during the first week of November, rising to -29% by mid-November, but increasing later in the month to -24% vs baseline.

From our analysis of suburban areas and high streets, we expect the recovery here to be much faster than for city centres. During the initial lockdown, we saw mobility on suburban high streets increase by around +5% per week from May. When local shops opened during June, we saw a +14% increase. We would expect an even greater shift in the run up to Christmas.

Why OOH now?

Despite the unprecedented year we’ve had, OOH still remains a strong option to reach consumers, having already experienced the largest increase in consumer trust during the pandemic; even greater amongst those aged 18-24. Research from the IPA revealed that during the first national lockdown, OOH still reached an average of 35% of 16-34s every day, easily in line with commercial TV audiences.

The ability of OOH to deliver trust, context and full flexibility for brands will remain crucial to reach consumers as they plan ahead for Christmas and divert spending online. Maintaining a presence as people shop for essentials, travel to work and school and attain respite through daily exercise will be crucial for brands. At Talon, we will continue to monitor the effects on audiences, through the current restrictions and into recovery.