REVIVE & REBOOT: HOW OOH CAN HELP YOUR BRAND EMBRACE THE SEPTEMBER RESET_

“63% still feel that September is an ideal month to make changes and set goals – it’s more than just textbooks and classrooms, September holds the power for all ages to embrace a transformative reset”

As the gentle breeze of Autumn fills the air, a sense of anticipation surrounds us. It’s that time again, when the end of the summer holidays signals a fresh, new year. And whether you liked or loathed that back-to-school feeling, there’s no denying it brought with it a need to get organised and start fresh.

Cue the onset of adulthood, and in comes a new routine, moving away from those long summer breaks onto an annual leave allowance. You would think this transition would make you leave that back-to-school feeling behind? But no. 63% still feel that September is an ideal month to make changes and set goals. – It’s more than just textbooks and classrooms, September holds the power for all ages to embrace a transformative reset.

In this blog, we shed light on YoY trends and category-level insights for the back-to-school reset of 2023 and delve into how brands can use Out of Home to impress consumers and bring home that A+.

But first, who is our audience?

TARGET PROFILES_

Based on our sample of 250 respondents, the survey results revealed the following distribution across the different target profiles. 19% were identified as part of the “Explorers” group, these are families with older children, nearing the end of their education journey and ready to embark on new adventures. Next is “Generation Next” which accounts for 21% of respondents, these are families with children in the middle of their education journey. 14% of the respondents fell within the “Tiny Tribers” group, these are families with younger children who are early in their education journey. Lastly, we had 39% of “Empty Nesters”, this group are pre-family and September for them is focused on the end of summer and getting back into routine and a busier schedule. This sample of respondents has provided us with a strong foundation for understanding the back-to-school reset audience.

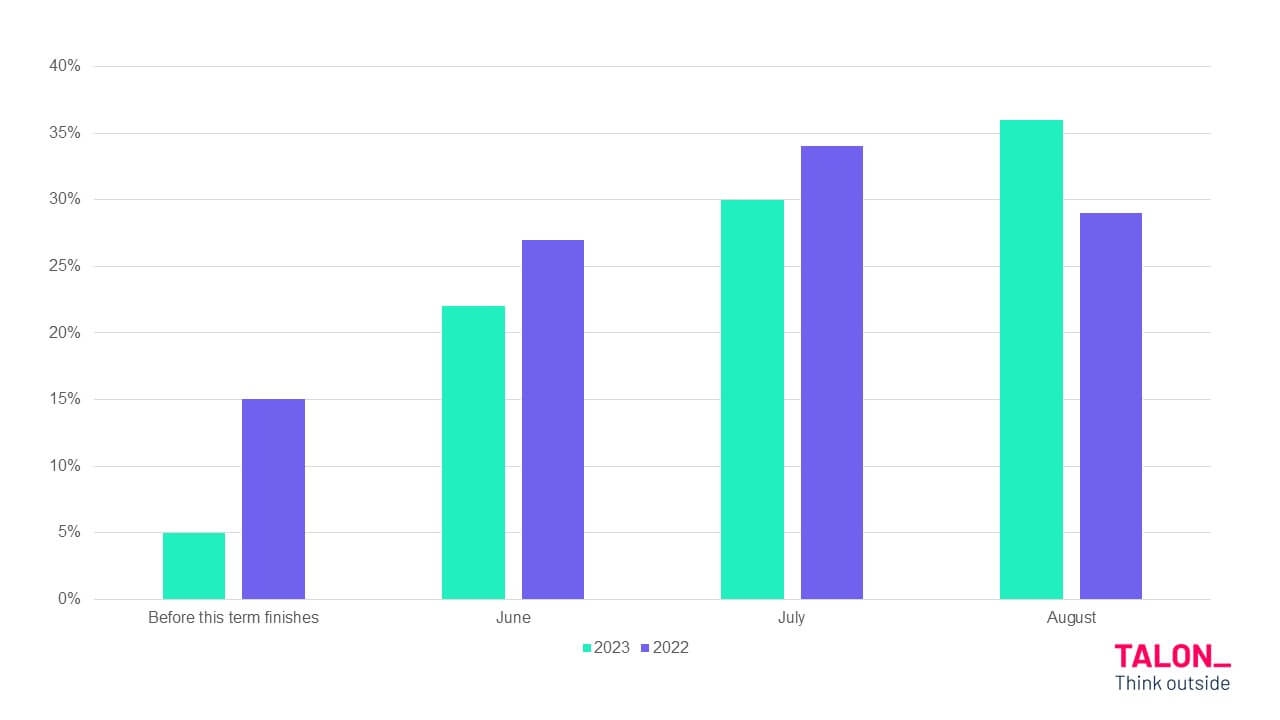

UNRAVELLING WHEN WE SHOP_

This year, most anticipate a later start for the back-to-school reset shopping period with August being the most popular month at 36%, followed by July at 30%. Only 27% of respondents have begun already, with 5% even leaving it till the week before new term starts. This is very different to last year where there was a notable shift towards starting much earlier.

Planning tip: Start early! Brands should build anticipation for the shopping season as early as possible. Through sustained brand building campaigns advertisers can achieve summer long engagement ensuring prominent recall when the moment arrives for making a purchase.

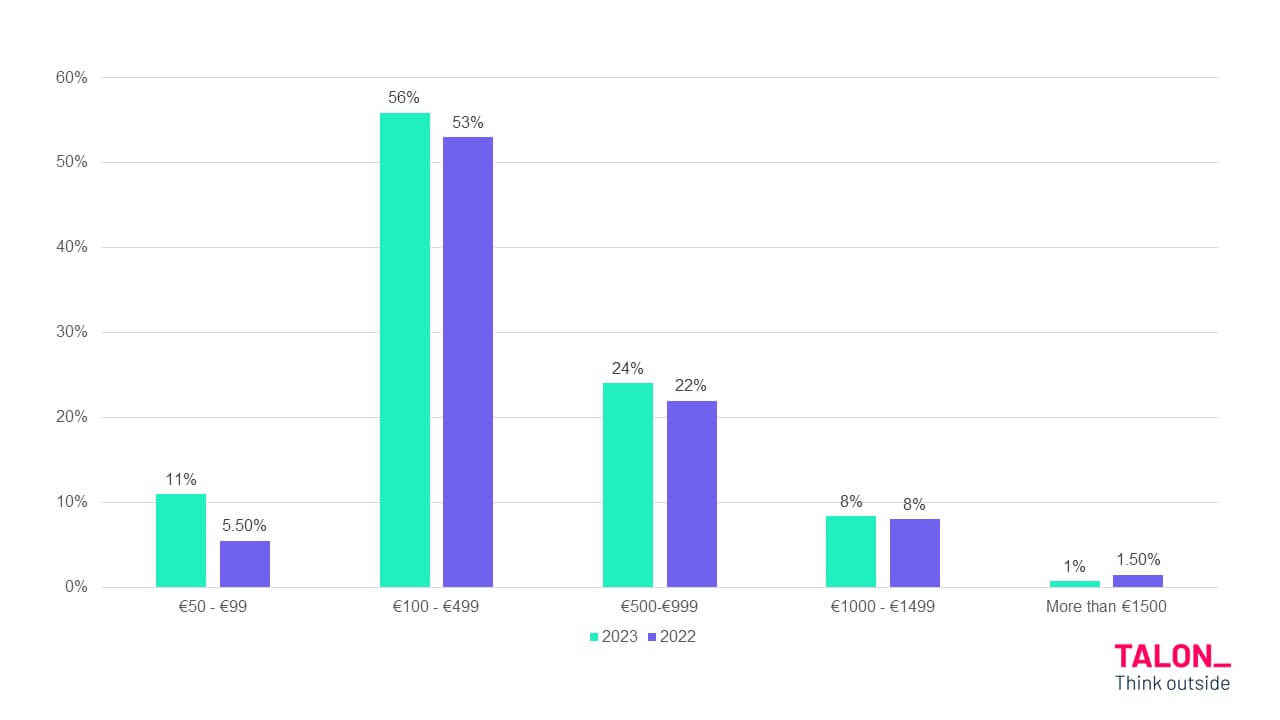

ANALYSING HOW WE ARE SPENDING_

Despite the governments release of its new free primary book policy, parents still envisage an increased level of spend for the back-to-school essentials in 2023 with spend increases across the board when comparing against 2022. Most respondents (56%) plan on spending between €100-€499. 24% answered €500-€999, followed by 11% answering €50-€99, with 8% even opting for the highest pricing threshold of €1,500+.

Planning tip: We know from our cost-of-living research that we have become a nation of savvy shoppers, with 63% of us now making lists. Considering the substantial increase in projected spending this year, consumers will undoubtedly seek value in their purchases. By leveraging the out-of-home medium, your brand can effectively convey your brand’s value messages and establish a strong presence that will in turn influence consumers choices and book a spot on that list.

SHOPPING TOUCHPOINTS_

Consumers will be shopping across a variety of stores, with Tesco keeping its top spot as the most popular (65%), followed closely by Dunnes (60%). 52% of respondents are once again choosing to keep things local by spending in local school supply stores in their area.

When examining the divide between brick n mortar vs online our results found that shopping centres (59%) and local shops (40%) reign supreme. A further 21% will be shopping on the high street with only 35% opting for online.

Planning tip: To effectively target consumers throughout their shopping journey, it is crucial for brands to have a pervasive presence. A multi-format campaign approach will enable you to reach consumers across a variety of environments throughout their day. By combining digital and classic out-of-home formats, you can strategically place your brand so that it’s top of mind during purchasing opportunities.

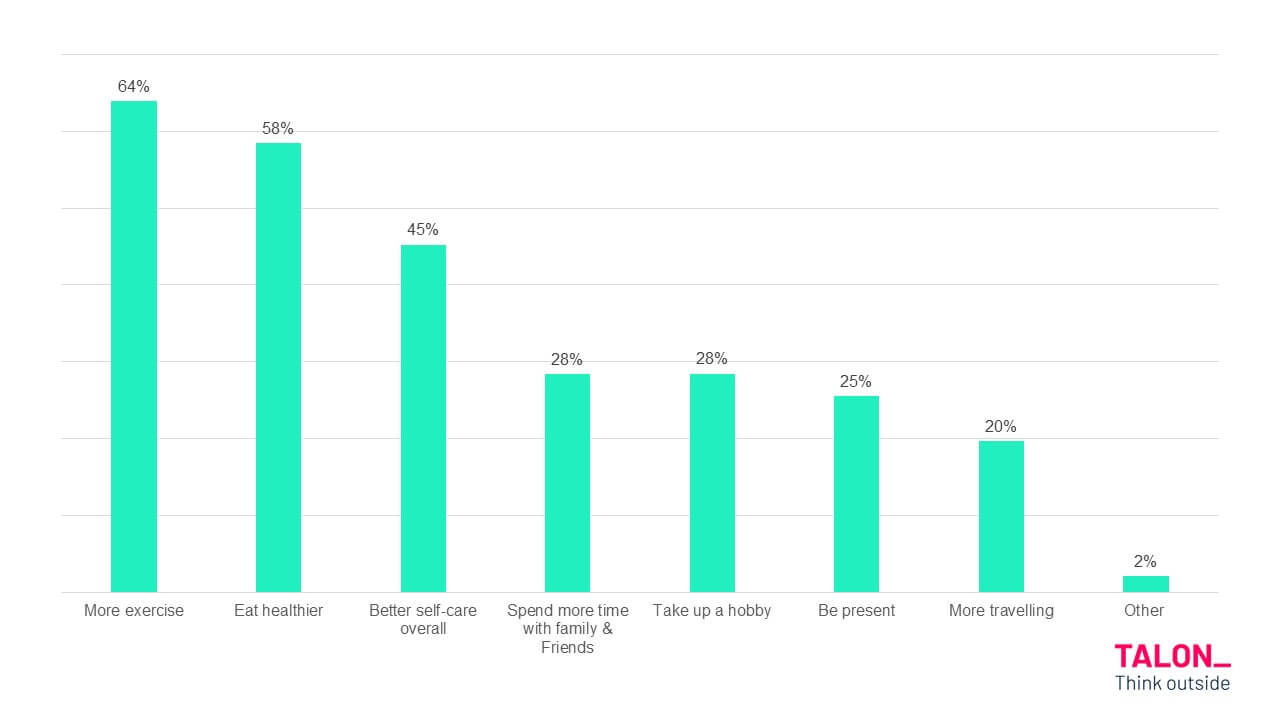

SEPTEMBER IS THE NEW JANUARY_

It’s not all bags and books, in recent years September has gained recognition as the new January with many seeing it as an opportunity to establish a healthier diet (58%), adopt a new fitness routine (64%), spend more time with family & friends (28%), or prioritise self-care (45%). In our survey 63% of respondents agreed that they are conscious of their lifestyle so setting goals in September helps to keep them grounded. It has become a bit of a wellness trend with health coach & wellness speaker Georgie Crawford launching this initiative back in 2022.

Planning tip: Data is your ultimate ally. Brands can utilise data to target the correct audiences effectively and identify areas with high footfall such as gyms, parks, and wellness centres. You can then layer this with consumer behaviour insights to tailor your out-of-home campaign so that it resonates with your target audience’s specific needs and preferences. This data-driven approach will allow you to deliver your message to the right people, at the right time and in the right moment – maximising impact and the effectiveness of your campaign.

The back-to-school reset period of 2023 is a huge opportunity for brands to reset and empower people of all ages – not just children. As the summer holidays end, this time of year embodies the very essence of embracing new routines, setting goals, prioritising a healthier lifestyle, and practicing self-care.

When comparing against the same period last year, there are a few changes to note. Nevertheless, our planning tips should provide brands with the necessary insights they need to capitalise on their campaigns and ensure optimal success.

Methodology: Research was conducted by Spark Market Research, on a main urban sample of 250 respondents 16+ using an online methodology. The research was conducted in June 2023.