2022 Outlook | Changes in Consumer Behaviour

Further Green shoots for Out of Home are reflected in the latest consumer sentiment piece carried out by Talon in conjunction with our research partners Spark Market Research.

The latest lifting of restrictions by the government has resulted in a return to old behaviours and the emergence of new ones, with all signs indicating that audiences are omnipresent.

With the latest mobility figures at 38% above baseline, consumers have returned to many of the behaviours and activities they missed. 70% of respondents agreed that they will spend more time meeting up with family & friends. 62% plan to eat out more while 51% plan to visit pubs more. It is no secret that Dublin and main urban areas experienced a downward shift in mobility throughout the pandemic. This is changing at a rapid pace. 55% of our sample agreed that they would return to meeting up socially after work more regularly with colleagues, which only highlights the previously mentioned stats on the return to restaurants and pubs.

Another key area in terms of leisure activities is the return to gyms and exercise classes. 48% plan on going to the gym or a class more. Student life is also set to resume, with 51% of students returning to face-to-face classes. Travelling abroad is one of the most overarching themes in the results with 63% planning to travel abroad more and not just on one occasion! The return to old behaviours presents a prime opportunity for brands across multiple categories to capitalise on reaching audiences on the move across multi environments. Given the rapid growth of DOOH inventory, the possibilities are endless.

The Great Return

Despite the adoption of hybrid working models, a new behaviour so to speak, a large proportion of respondents plan on returning to the workplace regularly. 61% of those interviewed said that they will be returning to their physical place of work most days, 45% of which will be returning full time. 45% of those returning to work will be commuting, with a further 42% using public transport as their primary means to travel to work. With long dwell times, transport and commuter formats are a prime environment to capture audiences on the move. According to Apple mobility (14th Feb), public transport is currently trending at 56% above baseline, presenting an opportunity for brands to reach audiences multiples times through classic and digital out-of-home formats. The rapid advancement in DOOH technology and big data allows clients to target consumers contextually, in the right environment, at the right time with the right message. Notwithstanding the value of the vehicular audience which has remained consistent. 50% of respondents agreed that they would commute to work by car, which strengthens our earlier Locomizer mobility figure at 38% above baseline.

Spending Power

One of the key trends we identified throughout the pandemic was the propensity for many consumers to save money, and our latest piece demonstrates that this behaviour has continued. 64% stated that they had saved money throughout the pandemic, 1/5 of which agreed that they had saved significantly more than normal.

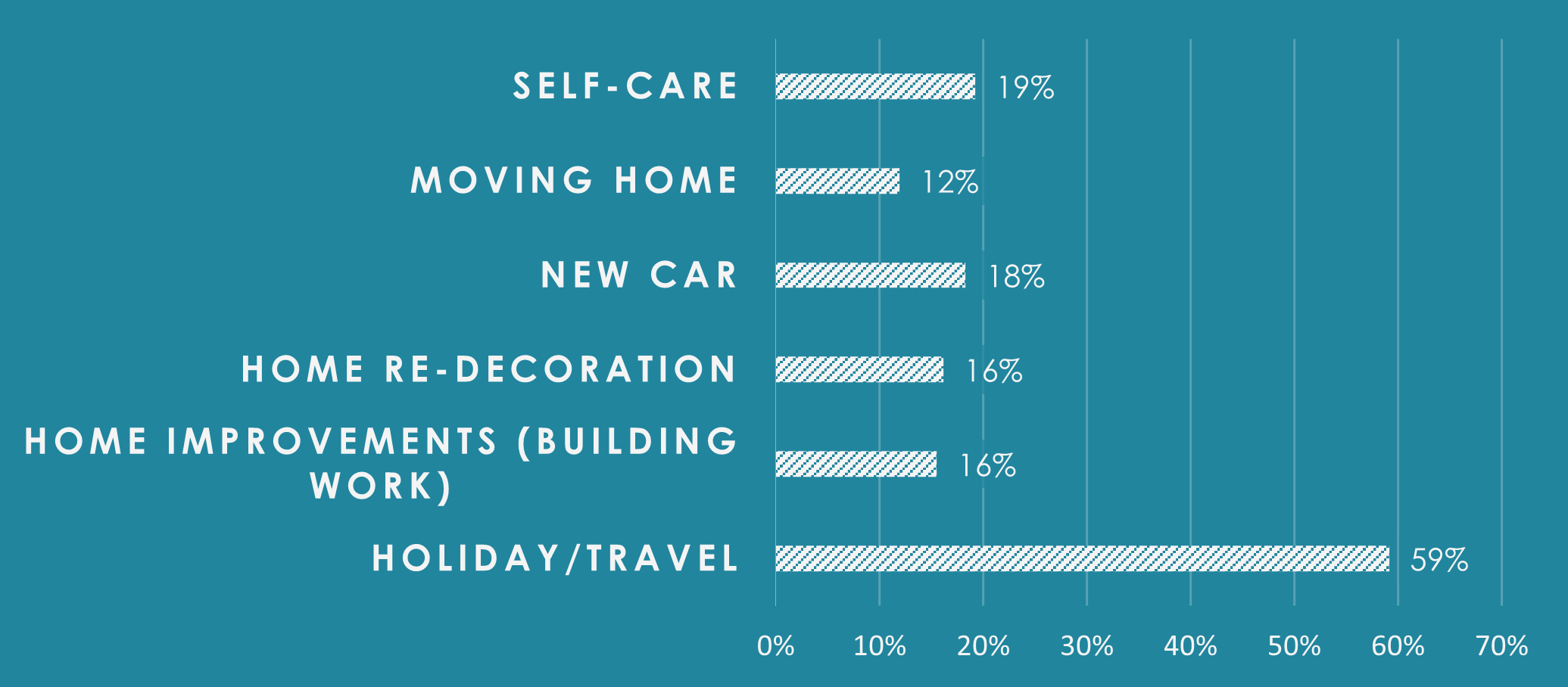

However, 83% of respondents interviewed plan on spending their savings on big ticket items in 2022. The highest spending categories will be holidays and travel, followed closely by home improvements and self-care:

It’s safe to say that Out of Home is on an upward trajectory. With the rapid increase in mobility and presence of audiences, continued investment in our medium, big data and technological advances the future is looking bright!