Q2 OOH Outlook | Media Landscape

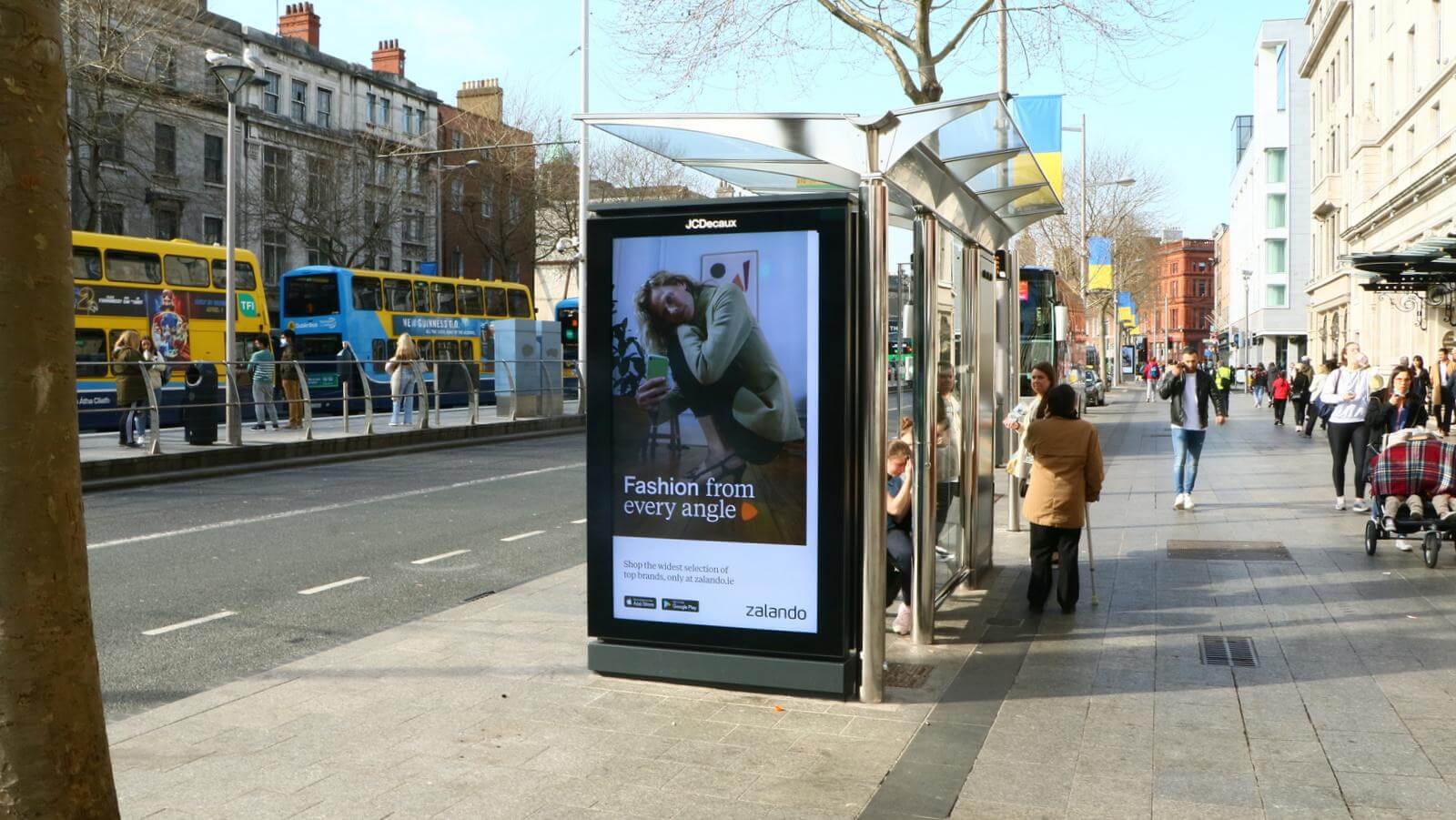

Following trends from a strong recovery in 2021 and a busy start to 2022, it’s clear there are further green shoots for the Irish industry as we head into what is shaping up to be a busy second quarter of the year. The last number of months have seen many positives for the OOH Industry, ranging from new clients to further development in our medium.

Trends & Spends

Out of home finished strong in 2021. Overall, the medium was down 28% versus 2019, which if you remember correctly was a bumper year for OOH. Digital Out of Home held its own and was up 27% on 2020. The flexible nature of DOOH has contributed to its share of spend, growing to 40%. Overall OOH spend was up 23% in 2021 (V 2020), with the retail category leading the charge. We’ve seen some great campaigns across the retail sector from each of the supermarket groups, all vying for consumer’s attention.

Travel & Transport is another top-performing category showing growth. Despite sharp increases in the cost of living, consumers are expressing a desire to travel abroad with the latest figures from DAA forecasting an estimated 25M passengers in 2022, these figures are in line with 2015 passenger numbers.

Alcoholic drinks, household services and confectionery & snacks were the 3 categories demonstrating the largest spend increases in 2021. Alcoholic drinks have shown a 73% increase when compared to 2020, which is very much in line with off-trade purchases and the return to the pub environment. Similarly, more reliance on at-home entertainment has meant that household services have also benefited, up 41% when compared to 2020.

The latest spend figures really demonstrate trust in our medium, once it was clear that audiences had ventured back outdoors, brands followed!

(Source: Nielsen 2021 Expenditure, DAA)

What to expect…

Our latest consumer research & mobility figures demonstrate that life has very much returned to normal. OOH audiences are in abundance with mobility currently standing at 55% above baseline. Commuting social activities and a return to what we did pre-pandemic is back. Our latest research piece offers further evidence with 70% of us planning on seeing family and friends more often, almost half are back to commuting to work, either by car, public transport or other means. 51% of students have returned to in-person lectures and classes. 62% plan on eating out more and I’m sure there is no surprise in hearing that 63% plan on travelling abroad more, given that so many of us have stayed at home over the last few years.

Despite hybrid working models in play across the country, a large proportion of people plan on returning to the office for most of the week. 61% of those we interviewed said that they will be returning to work 5 days per week. 68% plan on holding or attending face to face meetings, and 55% even plan on socialising after work.

With Easter imminent, plans are beginning to look a lot like 2019 when it comes to spending patterns and plans in general. 55% of consumers plan on spending more this Easter, through day trips, gifts, and shopping to name but a few. Shopping centres & the discounter stores will be the real winners this Easter, with 60% planning a trip to a shopping centre and 42% committing to shopping in the discounter stores.

Finally, one of the key trends we’ve seen as we head into Q2 is the desire for creative solutions in OOH. We’ve seen some brilliant executions over the last few months, including VW for their ID. range and most recently Suntory with the launch of Lucozade Alert. We have no doubt in our mind that the OOH Industry will continue to flourish as the year progresses!